The various items of property which you have and their value are very important in both a Chapter 7 and Chapter 13 and, in many cases, will be a significant factor in determining which chapter of the Bankruptcy Code for which you are best suited.

One of the biggest concerns of the individuals considering filing for Bankruptcy is that they will lose their property if they file for Bankruptcy relief. This concern is based upon false and/or inadequate information. In fact, in almost all Bankruptcy cases, individuals filing for Bankruptcy keep all of their property.

A. Distinguishing Exempt From Non-Exempt Property

B. Purpose for Distinguishing Between Exempt and Non-Exempt Property

C. Commonly Asserted Exemptions

D. Exemptions and Security Interests

E. Opportunity to Negotiate Regarding Non-Exempt Property

F. Exemptions in Chapter 13 Cases

A. Distinguishing Exempt from Non-Exempt Property

A significant distinction is made in the Bankruptcy Law between property which is “exempt” and that which is “non-exempt”. Specific items of personal and real property have been identified as “exempt” under New York Law. The distinction between exempt and non-exempt property is significant because exempt property is property which is beyond the reach of a Trustee in Bankruptcy. On the other hand, non-exempt property is property which is within the reach of a Trustee in Bankruptcy. Obviously, you would want as much of your property to be claimed as exempt as the law will permit. One of the schedules to your petition will ask you to identify any item of personal or real property which you own and which you are claiming to be exempt from a Trustee in Bankruptcy.

Example:

Darlene filed for Chapter 7 relief and, among her assets, she identified a 401K plan in the amount of $20,000.00 and a small boat valued at $2,000.00. New York law provides that a 401K is exempt but does not provide that a boat is exempt. Therefore, a Chapter 7 Interim Trustee would have the right to sell Darlene’s boat for the benefit of her creditors but not the 401K.

Note: With respect to the 401K, Darlene can keep the 401K and still obtain a discharge of her dischargeable debt.

In order to protect as many of your assets as possible from the Interim Trustee, you will want to assert as many exemptions as possible. Rest assured that in almost all cases involving consumers in Chapter 7, the assets which exist are either protected by state law exemptions or are of such little value that an Interim Trustee would have no interest in selling the non-exempt property having minimal value (generally less than $1,000.00) and distributing proceeds (minus the cost of the sale) to creditors.

B. Purpose for Distinguishing Between Exempt and Non-Exempt Property

The reason that the New York legislature and Congress have created exemptions is to:

- Enable an individual to retain property which is deemed critical for daily existence and to enable individuals to retain their dignity and self-respect

- Provide a means by which the government can tend to reduce the likelihood that an individual will require public assistance by providing for the exemption of various types of assets, including retirement assets.

In the context of a Bankruptcy Case, these two policies are considered to be more important than allowing a Trustee to look to this property to satisfy the claims of your unsecured creditors.

C. Commonly Asserted Exemptions

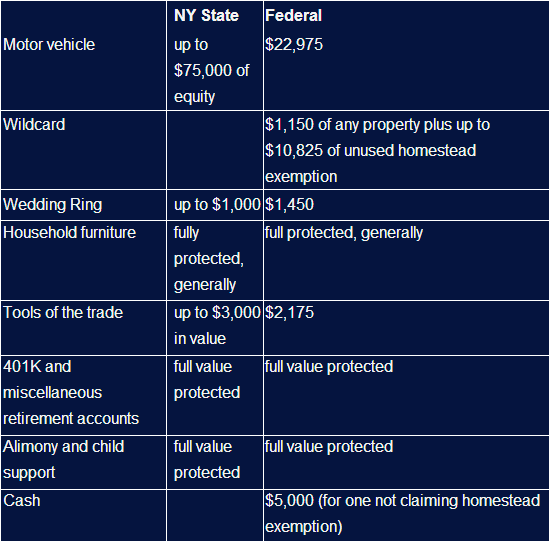

The following are some of the commonly asserted federal exemptions and New York State exemptions in Bankruptcy cases filed in New York:

D. Exemptions and Security Interests * Note: The following examples assume NY exemptions, rather than federal exemptions, are asserted *

Exemptions have no impact on a valid security interest or other liens which may exist against your property. Typically, the secured creditor must be paid in the amount of its secured claim in order to eliminate the lien. The lien can be thought of as diminishing the value of your own interest in the encumbered property. Therefore, only the value of the interest which remains after you subtract out the lien is the amount which is in need of exemption.

Example:

Greg files for Bankruptcy relief. He owns a car worth $7,600.00, which has a lien against it in the amount of $2,000.00 in favor of BIG BANK (which had years earlier provided Greg with the money to purchase the car). The amount in need of exemption is $5,600.00 ($7,600.00 minus $2,000.00).

Note: Although the amount in need of exemption in this example is $5,600.00, the largest amount that Greg is permitted to exempt under New York law is $4,000.00. Therefore, Greg can only assert a car exemption in the amount of $4,000.00 and the nonexempt portion of the car is $1,600.00 (i.e. $7,600.00 minus $2,000.00 minus $4,000.00).

E. Opportunity to Negotiate Regarding Nonexempt Property

* Note: The following examples assume NY exemptions, rather than federal exemptions, are asserted *

In a Chapter 7 case, the Interim Trustee who will review your case will look at your assets for the purpose of determining whether he can sell (at auction or back to you) any of your assets for the benefit of your unsecured creditors.

The Interim Trustee would prefer not to have to sell your “nonexempt” property. If there is a particular item of property which is nonexempt (or only partially exempt) and which has sufficient value to warrant a sale, the Interim Trustee will generally agree to refrain from selling such property provided you pay him or her in a lump sum amount (or installments within reasonable periods of time, generally one year) the amount of money which the Interim Trustee would likely have obtained at a public auction for the property in question.

Example 1:

Dan owns a car worth $6,000.00. He files a Chapter 7 case and asserts the available New York exemption for a vehicle in the amount of $4,000.00. The difference between the car’s value ($6,000.00) and the vehicle exemption under New York law ($4,000.00) is $2,000.00. Dan may be able to purchase the Interim Trustee’s interest in his car by paying the Interim Trustee this $2,000.00 amount (or less) in a lump sum amount (or over a reasonable period of time such as one year).

Example 2:

Dee owns antiques worth $4,000.00. There exists no NY law exemption to protect this asset from a sale by the Interim Trustee. Therefore, Dee’s bankruptcy attorney advises her that if she files for Chapter 7 relief, the Interim Trustee almost certainly will request a lump sum of the entire $4,000.00 value (or installment payments over a reasonable period of time) or, if Dee cannot afford the terms of payment, the Interim Trustee will have the antiques auctioned. Dee’s attorney should also advise her that she can keep the antiques by filing for Chapter 13 relief and making plan payments over 3-5 years in which her unsecured creditors are paid at least $4,000.00 (i.e. the value of her antiques).

F. Exemptions in Chapter 13 Cases

In a Chapter 13 case, the same analysis is performed to determine the value of nonexempt property which is used in the Chapter 7 context. In a Chapter 13 case, however, the existence of nonexempt property just means that unsecured creditors must be paid at least the value of this nonexempt property over the period of your plan. In other words, there is no risk that your property will need to be sold in the Chapter 13 case.